The GameStop (GME) short squeeze in Jan 2021 made headline when it went up nearly 30 times from $17.25 to $500.

You might be wondering what is a short squeeze?

In simple words,

GME had a short squeeze when the institutional investors (hedge funds) who initially had a short position of GME, but then later were forced to back at a much higher price to stop the loss of the short position.

You will learn,

- What is a short position?

- Who holds short position?

- What is a squeeze?

What is a short position?

A short position is basically owning negative shares of a stock. Well, how do you own a negative quantity of something?

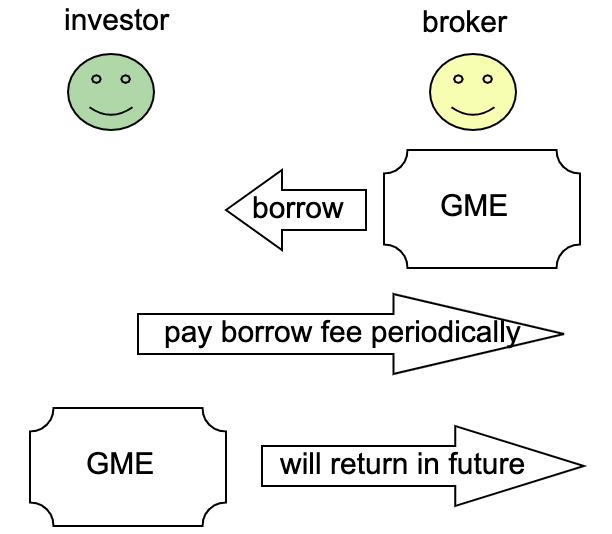

The investor enters a stock loan contract with the broker with the terms below:

- Investor borrows x shares of GME

- Investor agrees to pay a borrow fee (stock loan fee) periodically.

- This fee depends on how hard it is to borrow GME at the time and is variable over time

- Borrow fee = (value of x shares of GME) * (borrow fee per share)

- Investor agrees to return x shares of GME in the future

- The time to return the shares is up to the investor to decide

Why would the investor want to borrow a stock and then return it? It seems like the investor is only paying the borrow fee for nothing.

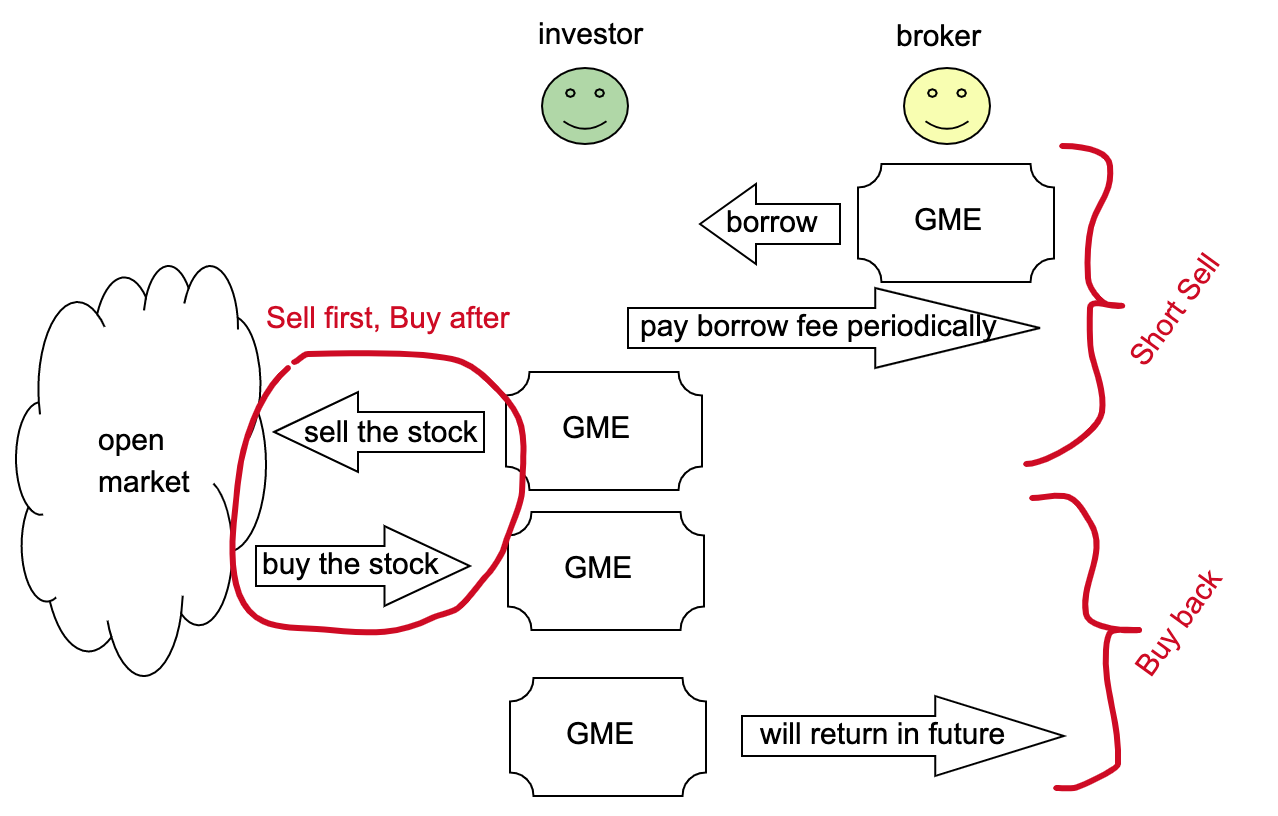

Well, two more transactions are happening between borrowing and returning the GME shares.

- Investor sells the stock in the open market right after borrowing the stock.

- Investor buys back the stock in the open market right before returning the stock.

First note to take is that the investor is selling before buy. This is opposite of what is not normal done in stock investing where you first buy then sell.

The effect of sell first buy after is that you make profit when the stock price drops between the sell and the buy. Let walk thru an example:

- Investor borrows 1 share of GME from the broker, which is trading at $20

- Investor sells the stock immediately in the market, thus receiving $20 of cash

- GME drops to $15 after 1 day.

- Investor is paying the borrow (stock loan) fee for the 1 day to the broker. This fee should be quite small since the period is only 1 day.

- Investor buys back the GME at $15 and keeps the $5 in the pocket.

- Investor returns 1 share of GME to the broker and close the contract, and earns $5 of profit overall.

In practice,

- The borrowing and selling are executed as one step which we call “short sell”.

- This way the investor does not need to go to the open market to perform a sell manually. It’s taken care by the broker.

- The buying and returning are executed as one step which we call “buy back”.

- This way the investor does not need to go to the open market to perform a buy manually. It’s taken care by the broker.

Who holds short position?

Any investor who has a margin account can enter a short position by short selling a stock.

- Often these are institutional clients (hedge funds) and day traders.

- Long term investors typically don’t hold short position because

- Most stocks are believed to increase over time, so shorting is losing strategy in the long run.

- The downside of short position is unlimited because the stock can go up many times of the original price.

Another criteria is the “inventory” from the broker.

- It’s very difficult for an investor to go out on the street to find someone who is willing to lend a stock to the investor.

- The broker has a lot of stocks in its inventory because it’s holding the stock for many of its clients.

- The broker can set a side some of the inventory to be lent out to short sellers and make some money on borrow (stock loan) fees.

- If many investors want to short a stock, we says the stock has a high “short interest”.

- When the short interest is high, that is a sign that the stock is weak and many people are speculating the weakness of the stock price.

What is the Squeeze?

In this scenario,

- The short interest of GME was high and many hedge funds are holding short position of GME.

- The short was so severe that 140% of the public floating shares have been sold short.

- There was a rush to buy the stock triggered by a subreddit/forum wallstreetbets.

- Many retail investors started buying GME in the market.

- The high frequency trading firms are also buy GME stock because of their algorithmic strategy (automatic strategies/bots that detected trends in the market and decided to follow).

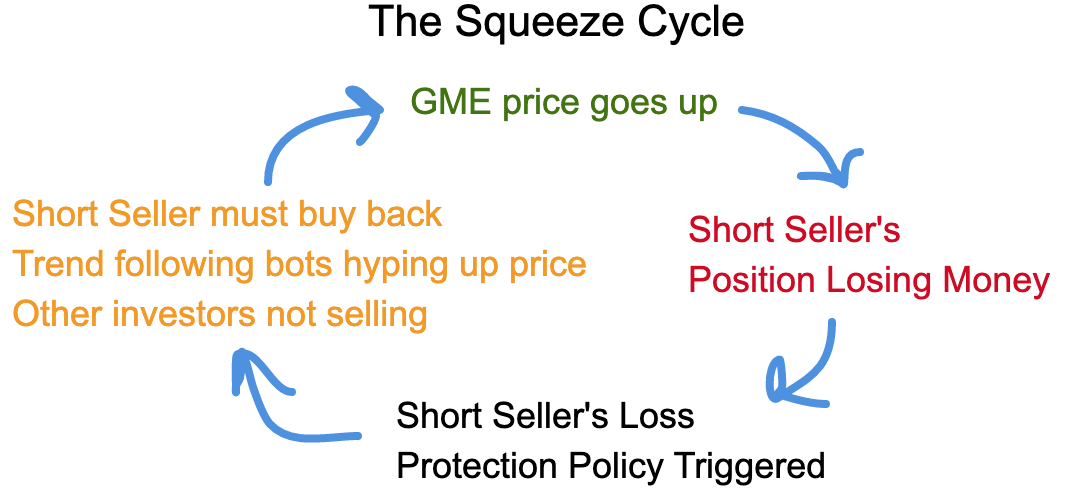

- The original short selling investors start to see loss in their short position, and some of them decide to buy back to cut the loss.

- Many retail investors were holding on the stock and not selling, and this behavior reduces the supply of the stock in the open market, which makes the stock price going up even more.

- The more the stock price went up, the more the short sellers were losing. Many of the funds have stop loss policies that were triggered and thus more buys were issues. Hence these short selling investors were squeezed.

- A stop loss policy is a policy where the firm is forced to close a position if the loss is beyond a specified limit.

- The Squeeze cycle is illustrated below:

This cycle can stop as the short position is decreased and thus reducing the demand of GME.

How can GME short shares be over 100% of the floating shares?

Let’s illustrate an example.

- Let says there are 100 shares of GME stock floating in the public market.

- One day, Investor X decides to short 50 shares.

- Investor X borrows 50 shares from a broker (the only broker)

- Assuming there is only one broker in the world, so the broker has the inventory of all 100 public shares, and it lends out 50 shares.

- Investor X short sells 50 shares in the open market, which means someone else bought 50 shares.

- Those who bought 50 shares would still broker their shares in the same broker (this means the broker gets the 50 shares of GME in its inventory back, resulting in 100 shares again)

- Investor X borrows 50 shares from a broker (the only broker)

- After a few days, Investor X borrows another 60 shares from the broker (note that the broker still has 100 public shares in its inventory)

- Investor X short sells another 60 shares in the open market. Again, those 60 shares are purchased by someone else.

- Note that Investor X has accumulated 110 shares in short position, which is 110% of the public floating shares.

- Investor X short sells another 60 shares in the open market. Again, those 60 shares are purchased by someone else.

- Note that this process can keep on happening multiple times for Investor X to get even more short shares.

i have been looking for a good explanation of “short squeeze”

this is so far the most clear and easy-to-understand version!!